Maira Myrogianni was appointed as Secretary General for International Economic Affairs in the Greek Ministry of Foreign Affairs on July 2023. She is a graduate of the School of Law of the National and Kapodistrian University of Athens and of the Faculty of Law of the University of Lille II in France. She is also a PhD candidate at the Faculty of Social and Political Sciences of the University of Peloponnese, her scientific interests focusing on the fields of Human Rights and European Law.

Maira Myrogianni has a wide and diverse experience in public administration, having served for several years as a legal advisor for international relations to the Ministry of Foreign Affairs, the Ministry of Maritime Affairs, the Ministry of Culture & Sports, the Ministry of National Defense and the Ministry of Labor & Social Affairs.

Secretary General Myrogianni spoke to Greek News Agenda* on Greece’s comparative advantages and why it attracts foreign investments at such high rate; the Greek economy’s more competitive sectors and its openness to international trade and markets; the importance of reforms outlined in the National Strategic Plan for Extroversion; how Greece has established itself as a digital innovation hub as well as an energy hub for Southeastern Europe, and is among the more climate-ambitious EU member states. Finally, the Secretary General spoke on the goals and initiatives of Enterprise Greece, the national state agency responsible for attracting foreign direct investment and promoting Greek exports.

What do you think are Greece’s comparative advantages? Why should someone invest in our country?

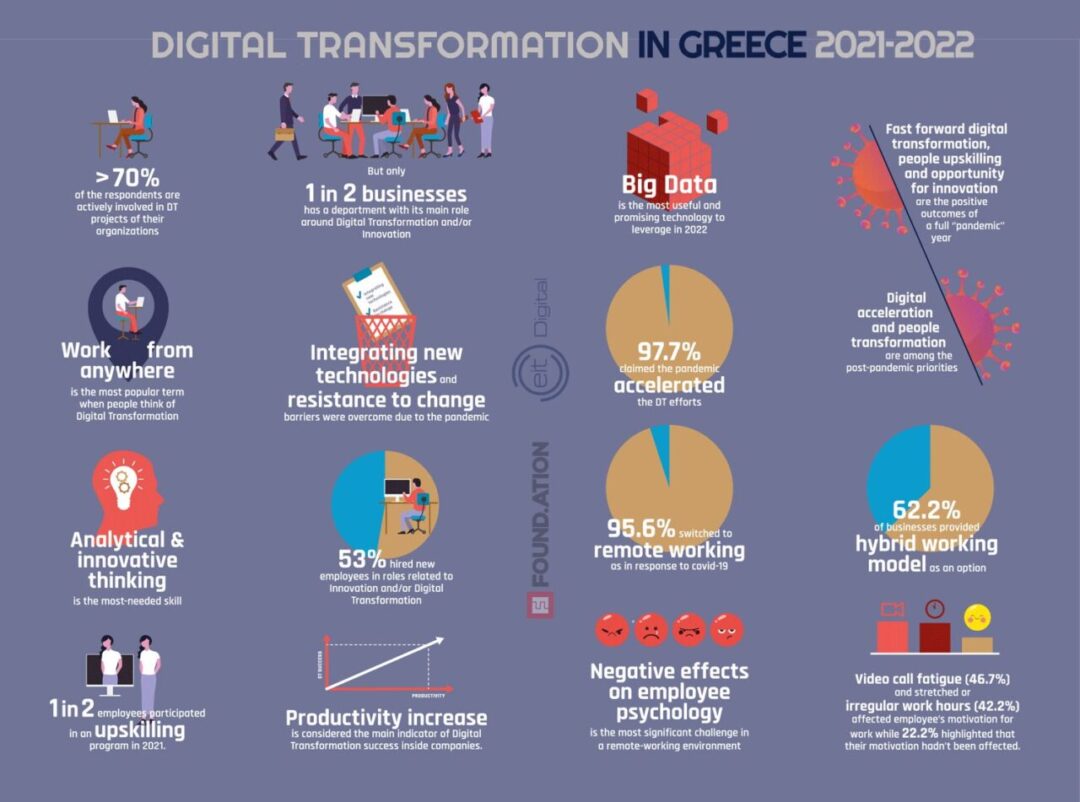

Our country is now considered a leading investment destination attracting large-scale investments. It’s not just momentum and favorable conditions that contribute to this, but other important factors as well, such as the improvement of the macroeconomic environment and the brave reforms promoted by the government, including rapid digital transformation, the reform of the tax system and the expansion of available financing tools (National Recovery and Resiliency Plan – Greece 2.0). At the same time, more than 1,500 public services were digitized, which contributed to speeding up the necessary administrative procedures for making an investment.

One of the country’s main comparative advantages is the availability of professionals that are highly trained, academically qualified, and proficient in multiple languages, while, according to recent data from the Ernst & Young “European Investment Monitor,” most prominent among the country’s appealing factors are: quality of life (75%), transport infrastructures and logistics (73%), telecommunications infrastructure / digital infrastructure (72%), Greece’s internal market (72%), and, as mentioned, skilled human resources (70%).

It is also worth bringing up the reform of investment incentives, both with the promotion of the new Development Law in 2022 that offers competitive investment incentives in the form of tax breaks, grants, wage and other subsidies, as well as with the substantial improvement of the framework for strategic investments, where investors can also enjoy an extremely wide range of incentives.

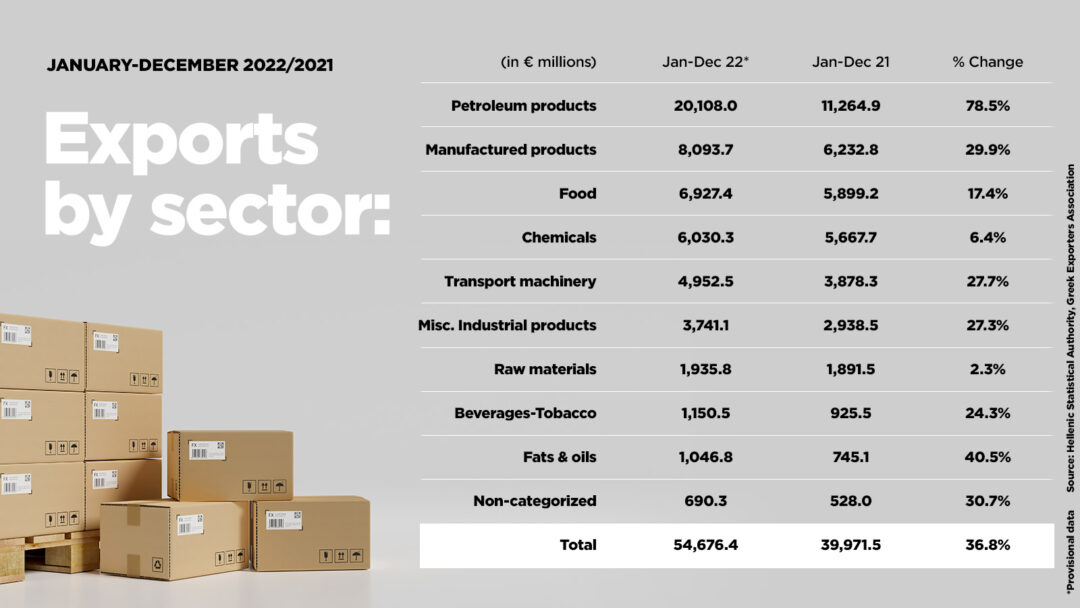

What are the most competitive productive sectors of the Greek economy and the most important markets for Greek exports? Are they venturing into new markets and if so, which ones?

Tourism, shipping, and agriculture by tradition comprise the Greek economy’s competitive sectors, while other strong productive sectors include the food and agri-food industry, energy production, management and conservation, construction and building materials, information and communication technologies (ICT).

In 2022, 55.1% of the country’s total exports was directed to the European Union, demonstrating the bloc’s special significance for Greek foreign trade, while other very important markets include geographically distant countries, such as the United States of America, China, Canada, and the United Arab Emirates.

In addition, there are ventures into new markets in Southeast Asia and Sub-Saharan Africa. For example, I recently visited Jakarta where I participated in the Indonesia-Europe Business Forum 2023 and presented on the occasion the opportunities that our country offers, especially in the areas of shipping, transport & interconnectivity, energy transition & Renewable Energy Sources and tourism. While in Jakarta, I also had the chance to discuss the promotion of bilateral economic and trade relations between Greece and Indonesia with political leaders and businesses entities.

Could one say that Greece has built a brand name in the investment sector, for example as a hub for technological/green investments or as a bridge between Europe and Asia in the framework of the National Strategic plan for Extroversion?

It is clear that the Greek success story has attracted investors to Greece, but also that Greek companies have become more extroverted, thanks also to the reforms outlined in the National Strategic Plan for Extroversion. The creation of a Greek brand name in the investment sector is now something tangible.

In recent years, Greece has been promoted as a digital innovation hub, with significant strategic investments in the field of IT and digital technology. What’s more, our country has been successfully positioned internationally as an energy hub in the wider region of Southeast Europe, thanks to its key geo-strategic position but also to the design and implementation of high-potential international connections, both in the electricity and natural gas markets.

Moreover, Greece is among the more climate-ambitious EU member states, supporting the goal of reducing emissions by at least 55% (as compared to 1990) by 2030, with the ultimate goal of achieving climate neutrality by 2050. The ambitious National Climate and Energy Plan (NECP) and the National Climate Adaptation Strategy (establishment of a National Council and preparation of regional adaptation plans), are fully consistent with ecological and other EU priorities, and in particular with the European Green Deal.

The National Strategy for Extroversion is a necessary tool for coordinating the country’s extroversion initiatives, but also an important tool for identifying and classifying target markets, actions and priority sectors for the Greek government and Greek enterprises, with the aim of supporting extroverted businesses and the organized promotion of the country’s international position and image. This is the road map for Greece’s extroversion actions.

Out of the 779 initiatives in total included in the 2023 National Strategic Plan for Extroversion, 130 concern the energy, environment and technology sectors, while the majority of initiatives (470) focus on the countries of Europe, the Balkans and the Middle East.

Could you briefly describe the goals Enterprise Greece? What initiatives has the organization planned for 2024 to attract new investments and reinforce the extroversion of Greek businesses and foreign trade?

Enterprise Greece, as the national state agency responsible for attracting foreign direct investment and promoting Greek exports, takes care every year to formulate the appropriate strategy relating to target markets, promotion sectors and types of business activities, depending on both the country’s needs and international conditions. We have laid the foundations for a new development model, which favors domestic entrepreneurship as well as direct foreign investments. The pillars of our development strategy focus on digital and green economy, but also on promoting social equity and long-term sustainability.

For 2024, our business planning includes a series of actions, such as holding targeted investment seminars or forums; organizing national participation in important sectoral investment exhibitions abroad; preparing and planning one-on-one meetings with international investors and organizing trade missions. At the same time, we continue to maintain and update an extensive portfolio of investment opportunities which currently includes 419 projects in various sectors of the economy.

Regarding the export sector, Enterprise Greece has designed and provides to export-oriented businesses an integrated, coherent program of services, actions and tools. The program focuses on providing three types of services: Networking, Training & Empowerment and Consulting & Information. It is also worth mentioning that Enterprise Greece has recently launched a new service for Greek exporters and potential export companies, the Export Help Desk, an innovative online platform offering daily updates to exporters on issues and procedures of foreign trade, as well as on the implementation of training programs.

Given the increase in foreign investment, as well as the new wave of investment expected following the recent recovery of Greece’s investment grade, in which areas does Enterprise Greece expect interest to be focused on in 2024?

It is a fact that Greece’s performance as regards direct foreign investment in recent years has been impressive. Greek exports have recorded a historic high: During the 3-year period 2020-2022, exports of goods increased by 77.6%, reaching a momentous 55 billion euro in 2022 (from 30.8 billion euro in 2020). These achievements of the Greek economy are expected to lead to a new investment wave, not only in its traditionally strong sectors like tourism, shipping and agriculture, but also in knowledge-intensive sectors, such as technology, research and development, health sciences, interdisciplinary innovation and start-up entrepreneurship.

We have already seen the first important instances of this, both with the dynamic investment entry into Greece of large multinationals corporations such as Microsoft, Google, Pfizer Cisco, HP, Digital Realty, Accenture and Deloitte in the fields of research, development and innovation, as well as with the significant investment wave attracted by the rapidly growing startup ecosystem in the country. It is worth noting that in 2021, the startup ecosystem attracted investments amounting to 540 million euro, while in 2022 the corresponding amount exceeded 325 million euro. It is worth noting that the vast majority (73%) of these investments were from abroad. In terms of target sectors, our operational action plan for 2024 aims at countries with significant investment potential –according to official data from the OECD and the Bank of Greece– while emphasizing sectors where Greece has a comparative advantage and in which significant investment mobility is observed, as for instance in tourism and real estate, IT and communication technologies, health sciences, agri-food, smart manufacturing, energy (RES, but also thermal production, electricity and natural gas networks, hydrocarbon research and development), environmental technologies, supply chain, business service centers and audiovisual productions.

* Interview to Ioulia Livaditi | Translation from Greek to English: Ioulia Livaditi; Editing: Magda Hatzopoulou

Read also from Greek News Agenda

TAGS: BUSINESS & TRADE | ECONOMY & DEVELOPMENT | EXPORTS | GOVERNMENT & POLITICS | INVESTMENTS